Monetising your on-farm natural capital

In our recent article What is Natural Capital? we explored the management practices, environmental and financial benefits as well as the current marketplace opportunities available to landholders.

The announcement by the Australian Government of a biodiversity stewardship program is another step forward for landholders to realise financial rewards.

Many farmers have the management practices in place, so what are the next steps in monetising your on-farm natural capital?

At Impact Ag Partners, we have worked with our clients to progress them through the Climate Solutions Funds process and understand the policy, procedures and requirements that need to be met for submission.

For those who are thinking of embarking on the process, this can be a challenging path to navigate. Before diving in headfirst, there are a few things you should consider in determining if you are ready for the process.

- Preparation of asset information – Landholders need to have all of their asset information clean and easily assessable. Early preparation of information can save time as the regulator has many demands.

- Choose the right project developer – Good communication and the ability to work within suitable timeframes are imperative when sourcing a project developer. This relationship needs to endure the 25-year life of the project.

- Data capture – Ensure clients have access to the right tools and support to develop, sequester and monitor their soil organic carbon (SOC) levels.

- Keeping your options open within the carbon market – Clients maximise their options to access private and public carbon markets with opportunities open in both the national and international marketplace.

- Appreciate the co-benefits of ecosystem services while developing and stabilising SOC – From animal welfare and enhancing above-ground biodiversity to building deep soil biomass, the health of the whole system supports farm productivity.

- Ensuring you have the right carbon investment – Choosing your investment in on-farm natural capital such as carbon, is like taking out an insurance policy that future proofs your assets against the risks of drought, fire and flooding rains.

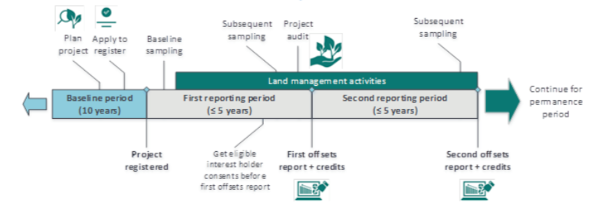

Example of soil carbon project timeline

Source: Clean Energy Regulator

Making the decision about next steps in monetising your on-farm natural capital can be challenging. The Impact Ag team are ready to assist you and can guide you the way forward that best suits your enterprise. From advice on building your soil organic carbon to assessing the value of your natural capital, Impact Ag can help you realise your potential.

Read our Case study_MONETISING ON-FARM NATURAL CAPITAL